Executive Summary

In recent years, Nigeria has seen a proliferation of agritech companies aiming to address world hunger and the challenges smallholder farmers face. Agritech companies strive to improve livelihoods of farm businesses through better access to inputs, credit, assets, and markets. Some of the companies offering these innovative digital solutions include Farmcrowdy, Thrive Agric, AgroMall, Hello Tractor, and Crop2Cash, among others.

The Nigerian government launched several policies in recent years to stimulate the agricultural sector, such as increasing the number of loans available to farmers. However, these policies were not specifically designed with agritech in mind. Today, while there are many agritech start-ups in Nigeria, only few have scaled. Barriers include a challenging business environment, an ecosystem not geared to support long-term growth, low levels of agricultural knowledge and skills, and limited access to funding opportunities.

A range of funders and support organizations are active in the Nigerian agritech space, such as incubators, accelerators, angel investors, and donors. Most of these funders mentioned have typically invested at early stages of agritech sartups. However, mid and late-stage investors, like impact investors, private equity firms, and large corporates, have shied away from Nigerian agritech due to the perceived risk of agriculture and the opportunity cost compared to other sectors. While some funding is available in the early stages, Nigerian agritech companies face three major funding gaps: limited availability of local capital, a lack of institutional investors in agritech, and an inability to attract big-ticket long-term investments.

Both local and foreign investors can influence the agritech sector from an early stage, but this may require patient capital and greater awareness of agritech business models and their impact. Start-ups should seek long-term and patient engagement with investors to raise awareness of the benefits their digital solutions could bring to farmers, and how investors might benefit from working with them. Companies such as AFEX and AgroMall have worked effectively through government initiatives to stimulate rural financial inclusion by using their digital solutions to provide loans to smallholder farmers.

Government policy still has a huge role to play in attracting investment into agritech. The Nigerian government policies could support the agritech sector by creating an enabling environment for innovation, primarily for digital financial services and mobile money uptake. The agritech sector stands to benefit from the development of physical and financial infrastructure to support the agricultural ecosystem, as well as from policies designed to improve the basics of the business environment and attract investment.

Introduction

In the 1960s, Nigeria was one of the most promising agricultural producers globally. Export crops dominated foreign exchange earnings; the country was the top palm oil exporter worldwide and was responsible for almost half the world’s groundnut production.

Nigeria’s agriculture sector has since seen a steep decline. Whereas the country;

Once grew around 18% of the world’s cocoa, its share of production is now down to 8%.

Once responsible for producing 65% of tomatoes in West Africa, Nigeria is now one of the largest importers of tomato paste.

Over the last 20 years, a decline in groundnut, palm oil, cocoa, and cotton production has led to a missed opportunity of around $10bn in export earnings.

Increases in crop production have been surpassed by population growth, leading to a reliance on food imports and a decline in economic self-sufficiency.

Despite experiencing an oil boom from the 1960s onward, agriculture has remained vital to Nigeria’s economy, accounting for around a quarter of gross domestic product (GDP) and employing up to 36% of the country’s working population.

Key crops include rice, wheat, maize, cotton, soybeans, and cassava. Rice remains an essential staple for most Nigerians, with around seven million tonnes consumed annually.

The country is Africa’s leading consumer of rice and one of its largest producers, and one of the largest importers of rice globally.

Nigeria is also the largest global producer of cassava, producing around 50 million metric tonnes (mmt) annually.

Both crops are grown predominantly by smallholder farmers, who sell around 80% of their harvest. Large-scale commercial plantations are rare.

Since the 1970s, agriculture in Nigeria has faced numerous challenges that have resulted in low yields and post-harvest losses.

These challenges include limited access to land for smallholder farmers, an over-reliance on rain-fed irrigation, limited adoption of modern technology, inadequate storage facilities, and poor access to markets.

Expensive and poor-quality inputs, and limited access to credit facilities, have exacerbated the situation, leaving Nigeria, a former agricultural powerhouse, with low agricultural productivity compared to its neighbors.

The average yield for cereals in Nigeria is 1.46 metric tonnes per hectare (mt/h) while Ghana produces 1.87mt/h and Côte d’Ivoire produces 2.15mt/h.

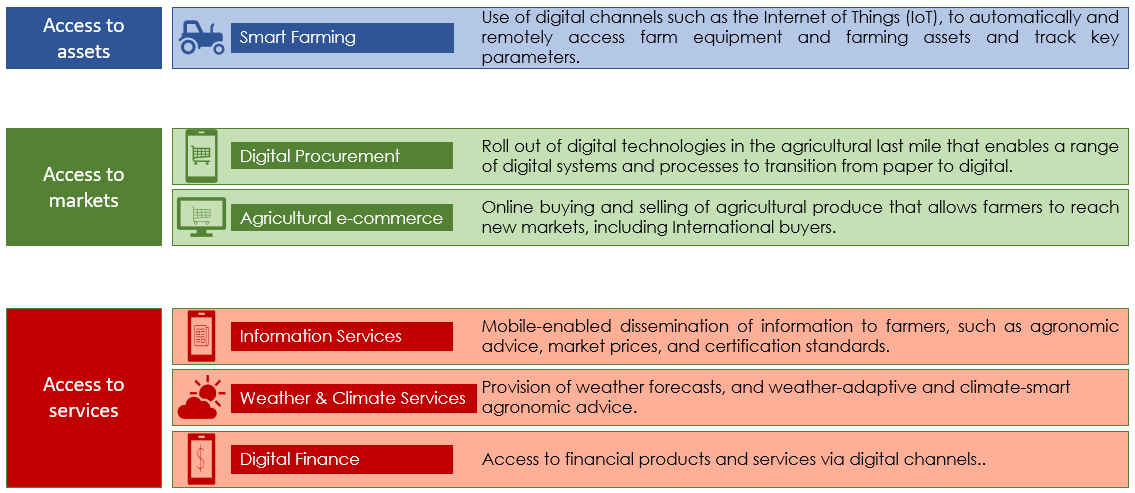

In recent years, a growing number of agritech companies have begun offering digital solutions to address the challenges faced by smallholder farmers in Nigeria.

These solutions aim to improve smallholder farmers’ access to financial services, farm inputs (e.g., good quality seeds), fertilizers, insecticides and pesticides, and equipment (e.g., tractors), as well as provide other extension services to farmers.

Many agritech solutions improve farming methods and introduce best practices while monitoring farmers’ progress from the start of the farming season through to harvest. New digital tools are also enabling farmers to access markets by connecting them with produce buyers.

The growing number of agritech companies across Sub-Saharan Africa has led to an increase in agritech investment. In 2019, around $63mn was invested in agritech in Africa.

Kenya, Nigeria, and Ghana are the most vibrant agritech markets, collectively accounting for 60% of active start-ups in Africa. West Africa is now home to two of the top three agritech ecosystems on the continent.

Nigerian companies, including Farmcrowdy, Thrive Agric, AgroMall, Hello Tractor, and Crop2Cash, have benefitted from grant funding to achieve social impact. Some have even attracted commercial investment.

These companies have launched digital solutions that aim to improve farmers’ access to markets, finance, assets, and actionable data-driven information.

Farmcrowdy and Thrive Agric offer platforms for the general public to crowdfund farmers while Hello Tractor offers a shared tractor service. AgroMall uses farmer data to generate economic identities for farmers while Crop2Cash’s solution digitizes entire value chains and provides digital payments.

Donors, angels, innovation hubs, and non-governmental organizations (NGOs) have all supported Nigerian agritech companies in the early funding stage, but the funding landscape is likely to become more complex as technology companies seek to scale further.

Institutional investors offering higher investment ticket sizes, such as impact investors, development finance institutions (DFIs), venture capital, and private equity firms, have so far refrained from investing in agritech.

Instead, these investors are largely concentrated in sectors such as energy, fintech, and education.

This report aims to analyze the evolution of agritech investment in Nigeria and the role different investors have played in the growth of the sector.

We try to point out the investment trends in Nigerian agritech, the types of funding gaps, and possible opportunities for agritech companies to grow further. This report also looks at opportunities for investment to “crowd in” additional resources.

Snapshot of some Agritech Players in Nigeria

Categories of Digital Solutions

List of some agritech startups

Use Cases & Users

Agriculture Stats in Nigeria

Despite an oil boom over the last four decades, agriculture remains the core of the Nigerian economy and the main source of livelihood for most Nigerians. As of 2019, agriculture contributed around 26% to the country’s GDP, up from around 20% in 2018.

Agriculture in Nigeria: Import & Export

Prior to the end of the Nigerian Civil War in 1970, Nigeria was both self-sufficient in food production and a major food exporter. Since then, food imports have outstripped exports. Agriculture accounts for about 1% of Nigeria’s total exports while 7% of all imports are agricultural produce. As of 2018, fermented cocoa beans were the only Agric product in Nigeria’s top 10 exports, cashew nuts, sesame seeds, and raw cocoa beans have since been included. Crops that Nigeria is capable of producing at scale.

Agricultural Development Initiatives

Following an oil crisis in the 2010s that led to declining oil-based revenues, the Nigerian government embarked on a policy of economic diversification.

Agricultural development is a key goal, especially due to the country’s heavy reliance on food imports.

A variety of agricultural initiatives have been launched, including ones promoting the use of digital technology in agriculture, leading to a nascent agritech sector.

From 2011 to 2015, the Nigerian government implemented the Agricultural Transformation Agenda (ATA), which sought to support agriculture by introducing business-like practices to the sector. The policy prompted a renewed interest in agriculture, particularly among investors. One of the policy’s key achievements was to restructure the nationwide fertilizer procurement system. To combat inefficiencies and fraud with the input subsidy scheme, the government established the Growth Enhancement Support Scheme (GESS) in 2011. Through the GESS, farmers received vouchers for subsidized fertilizers and seeds directly on their mobile phones through an electronic wallet provided by Cellulant, a mobile payments provider.

Cellulant was later selected by the Federal Ministry of Agriculture and Rural Development (FMARD) as part of the Nigeria Agriculture Payment Initiative (NAPI) to digitize agricultural payments and improve rural financial inclusion.

Following the ATA, the government launched the Agriculture Promotion Policy (2016–2020) in 2015, as well as several agricultural development initiatives.

These includes:

Anchor Borrowers Program (ABP),

Presidential Fertilizer Initiative (PFI),

Youth Lab,

Presidential Economic Diversification Initiative (PEDI),

Food Security Council, and

Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL).

Created by the Central Bank of Nigeria (CBN) in 2017, the ABP works in partnership with state governments and private sector organizations to provide farm input loans and cash for farm laborers and smallholders to boost agricultural production.

At harvest time, farmers send their produce to off-takers or agro-processors (the anchors) who then pay the cash value of the crops into the farmers’ accounts, less the cost of the loans provided.

While typical bank loans carry an interest rate of 30%, ABP loans have a lower rate of 9%. As of June 2019, around 1.1 million farmers producing 17 different agricultural products had participated in the program.

Impacts of Government Policies on the Sector

The Agriculture Promotion Policy enabled the Nigerian government to recognize the need to “commercialize new agricultural technologies that meet local market needs”.

However, the government’s programmes to improve access to agricultural finance have had a greater impact on agritech in Nigeria than its policies.

For instance, although not designed to benefit agritech specifically, government-backed incentives like the ABP have aided the growth of Nigerian agritech companies, such as AFEX and AgroMall.

AFEX was launched in 2014 to develop a warehouse receipt system in partnership with the FMARD. The system enabled smallholder farmers and cooperatives to store their produce safely at approved warehouses and use receipts as collateral for loans across four states in Nigeria. AFEX built on the success of this project to become a commodities exchange platform and participated in the ABP as an aggregator.

Founded in 2016, AgroMall provides farmers with a digital profile, including geo-coordinates of their farmlands, which allows them to access input credit and open bank accounts. AgroMall also participated in the ABP in 2017 as one of the programme’s services providers.

While AFEX and AgroMall grew through their engagement with government-led initiatives, other companies and innovators have managed to launch and grow without direct government support.

Recent policy has sought to encourage federal, state, and local governments to create a stable and healthy investment environment for agricultural development. This has contributed to the emergence and legitimacy of new digital solution providers, such as Farmcrowdy, BeatDrone, Thrive Agric, Crop2Cash, and Verdant AgriTech.

Agric Tech Investors

There is a range of funders in the Nigerian agritech space, including early-stage funders such as incubators, accelerators, angel investors, and donors, and mid-stage investors such as impact investors and venture capital firms.

Start-ups typically begin their funding journey by joining an incubator, a company that offers office space and provides business advice (Some incubators give capital to their best-performing start-ups). They then join an accelerator(usually). Accelerators provide an intense, rapid, and immersive capacity-building experience on business management principles and skills.

Many Nigerian agritech start-ups have been supported by local incubators, such as Passion Incubator, Wennovation, and CC Hub. A few also enrolled in international accelerator programmes. Both Thrive Agric and Farmcrowdy received investment and support from US-based Y Combinator and Techstars, respectively.

To scale further after early-stage funding, agritech companies need to target higher ticket investments from impact investors or venture capital firms. Impact investors are investment management companies that invest capital to derive positive social outcomes. Impact investors can be either venture capital firms or philanthropic investors and typically provide patient capital. Unlike traditional investment from profit-focused venture capital or private equity firms, patient capital can be invested and recouped over a longer time frame.

Late-stage investors, like private equity firms and corporate investors, are currently inactive in the agritech space as they tend to invest larger amounts in established start-ups (across all sectors) with a proven business model and a history of generating profit.

A potential next step would be to seek investment from angel investors or international donors. Angel investors are common in Nigeria and often provide early-stage funding even before a start-up joins an incubator or accelerator programme.

International donors providing concessional finance, such as GIZ, UK aid, and USAID, are also active in the agritech space in Nigeria. Concessional finance is the type that does not seek a market return, such as grants, competition prizes, or funding for specific projects. Concessional funds can be pioneering in nature and are usually provided to build capacity, demonstrate success by testing service or proof of concept, and crowd in other investors.

While impact investors target financial gains, they also prioritize social impact as a specific outcome. Acumen, GreenTec Capital Partners, and Palladium are examples of international impact investors active in Nigeria. However, with the exception of GreenTec Capital Partners investing in Farmcrowdy at the early stage, few other impact investors are currently active in Nigerian agritech.

Venture capital firms invested about $747mn in Nigeria in 2019, with 62% of investments going to fintech companies. In contrast, Nigerian agritech start-ups barely raised $2mn in the same year.

A major reason for the lack of investment in agritech in Nigeria is the high perceived risk of agriculture as a business and low expectations of the potential return on investment.

While investment is available at the early funding stages, subsequent finance is not easily available to agritech start-ups after the seed stage. This creates funding gaps for start-ups to overcome.

Nigerian agritechs face three types of funding gaps:

Limited source of local capital beyond the preseed stage;

Low availability of institutional investors; and

An inability to attract big-ticket investments.

Agriculture is the largest sector in Nigeria’s GDP, so it will be interesting seeing the rise of agri-tech startups as they attempt to digitize this significant part of our economy. This is certainly just the beginning.